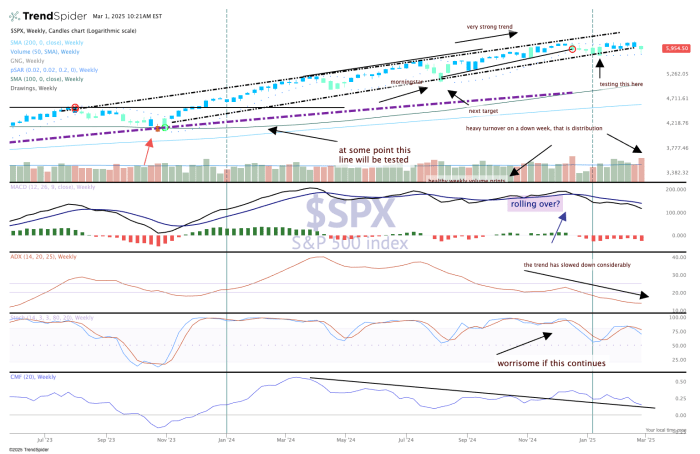

This past week was not a positive one for the bulls.

Notice the high volume bar this past week (arrow, notation, below), that indicates big selling by institutions. But, you may ask about the strong action on Friday, up nearly 2%. My friends, I’m here to tell you that bottoms are not often made on a Friday. The erratic movements of late are quite disturbing, the last three days of the week were indicative of poor liquidity, no trend or momentum and plenty of volatility.

The VIX finished above 19% and hovered near 20% for most of the day. There is some more volatility to come over the next several weeks, and with few catalysts to drive stocks higher other than positive economic news (which has been nascent), well the onus is on the bulls to make a stand.

The indicators have not changed much here but notice the candle turned to teal, which is still cautiously bullish. But the move down below the range drawn in (you can see it if you squint) tells us the trend is moving down.

Of course, all of that can be rehabilitated quickly with a couple of higher-high, higher low-candles in March. But when seasonal trends are bearish, that would be some heavy lifting.

More Pro Portfolio